SCISSORS PROJECT 2023

Panel sell-out Hairdresser

SCISSORS INSIGHT: IN-DEPTH ANALYSIS ON BOOMERS CONSUMERS

24 MAGGIO 2023 | GIORGIO NUNIA & GLORIA LANZA

SCISSORS PANEL

Since 2017, TOTENExT in collaboration with BOSS Srl has been monitoring a Panel of around 1.5k hairstyling salons distributed throughout the national territory that can provide insights into the products resold by salons, client frequency at the salons, services provided, prices, receipt composition, etc.

Data weighed as to represent the situation in Italian hairstyling salons by number of employees and prices of services.

SELECTION OF CONSUMER SAMPLE

Selection of 47k client codes:

- Belonging to consumers who are female

- Who have visited the salons continuously in the four-year period 2019-2022 (at least once every 12 months)

- Whose date of birth has been recorded

- Between 15 and 84 years of age

CUSTOMER MODULE

Analysis of the consumption and behavior of the consumer sample in the 2019-2022 time frame.

Sample data expanded to around 13 million (around 70%* of the total hairstyling salon clients).

(*we excluded consumers of «small-less expensive» salons not present in the Scissors sample and consumers who go less than once every 12 months or irregular frequency).

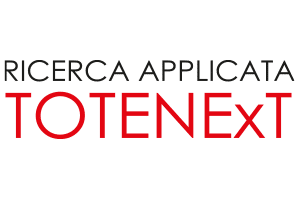

Between 2019 and 2022, there has been a rapid aging of the population: both the population graph (ISTAT data) and the expanded sample graph show a significant drop in the weight of the groups between 25 and 54 years of age and the increase in the weight of the over 55.

In 2022, the Boomer consumers (the two age groups of 55-64 and 65-74 are considered), against a 32% population penetration, represent almost 37% of the total salon clients.

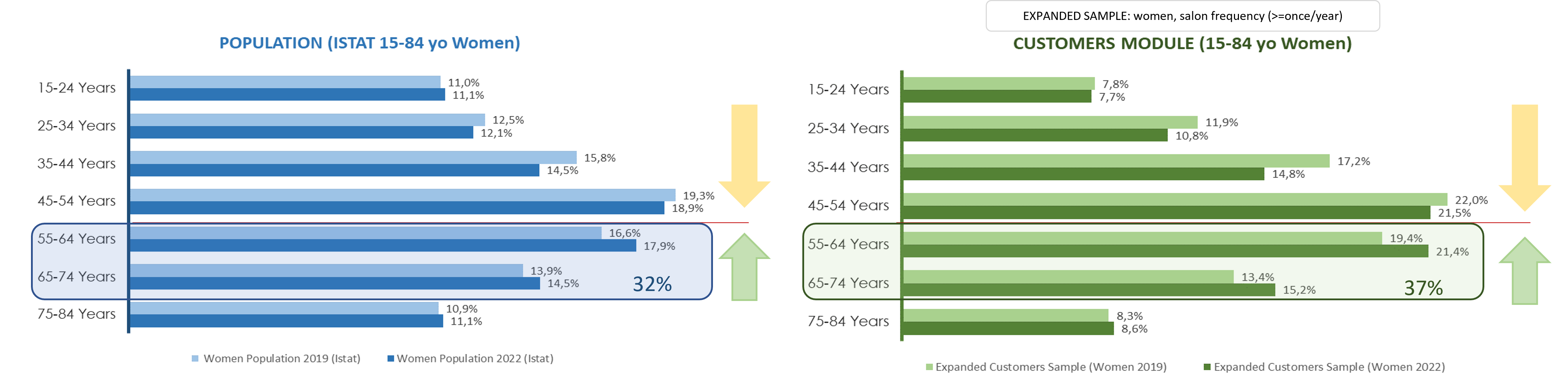

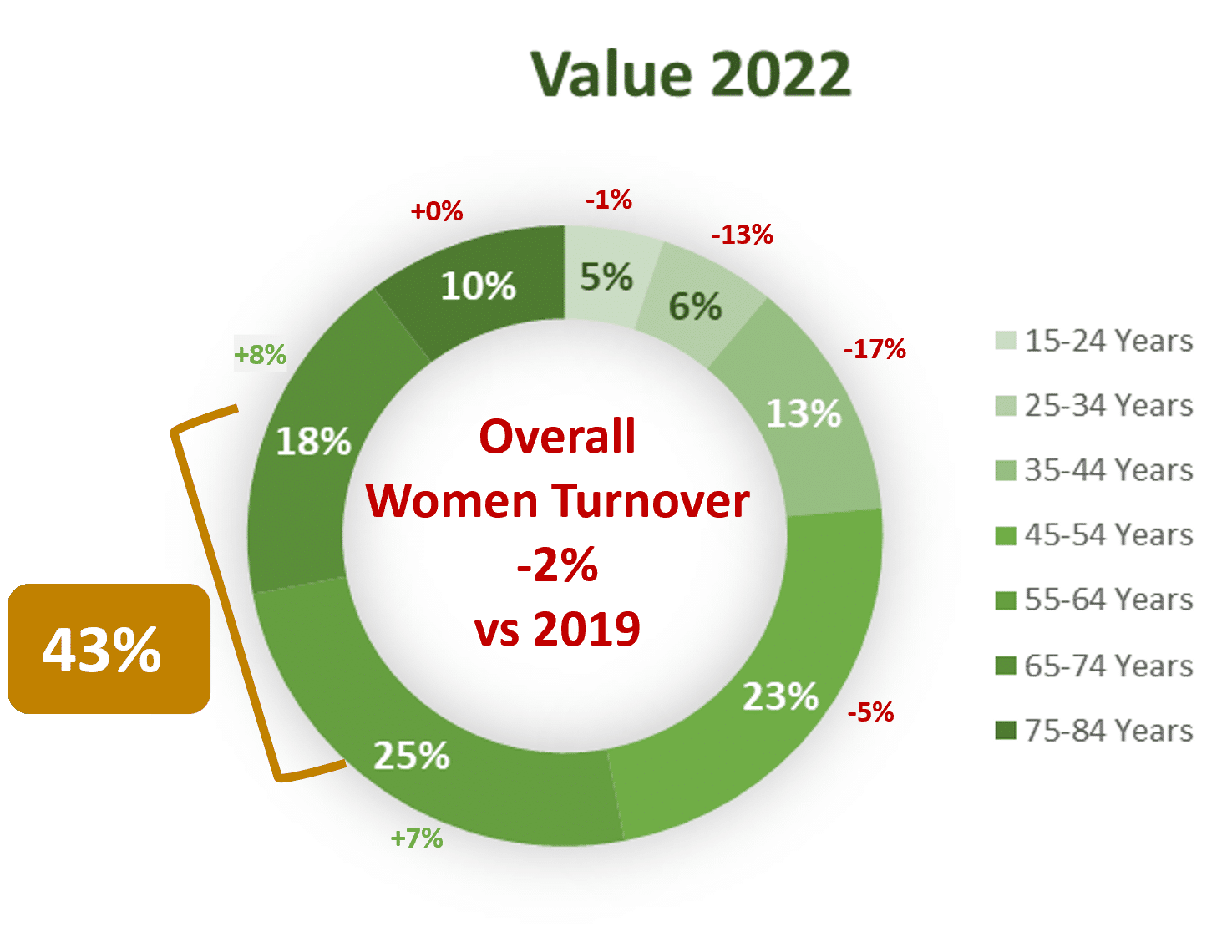

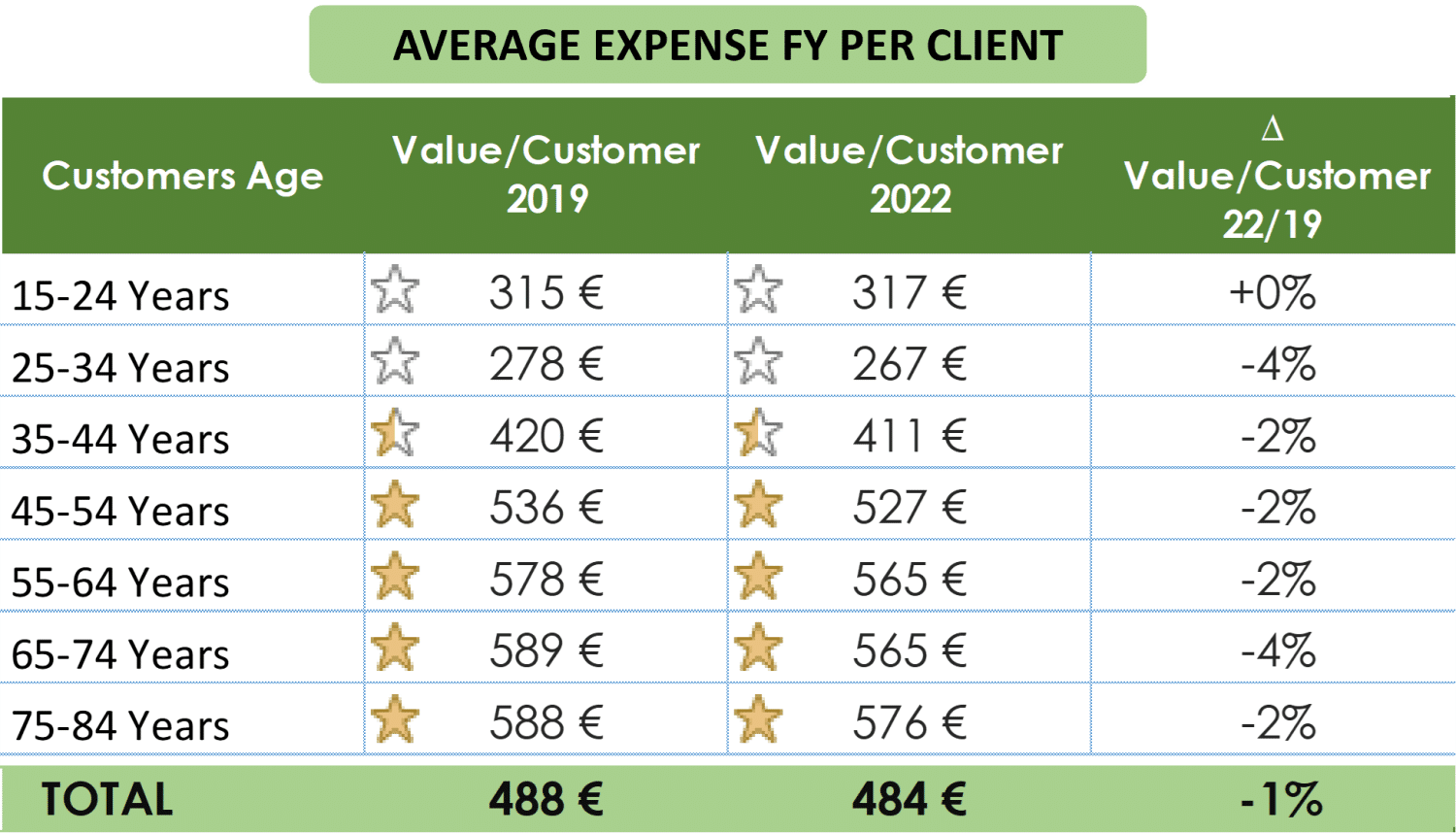

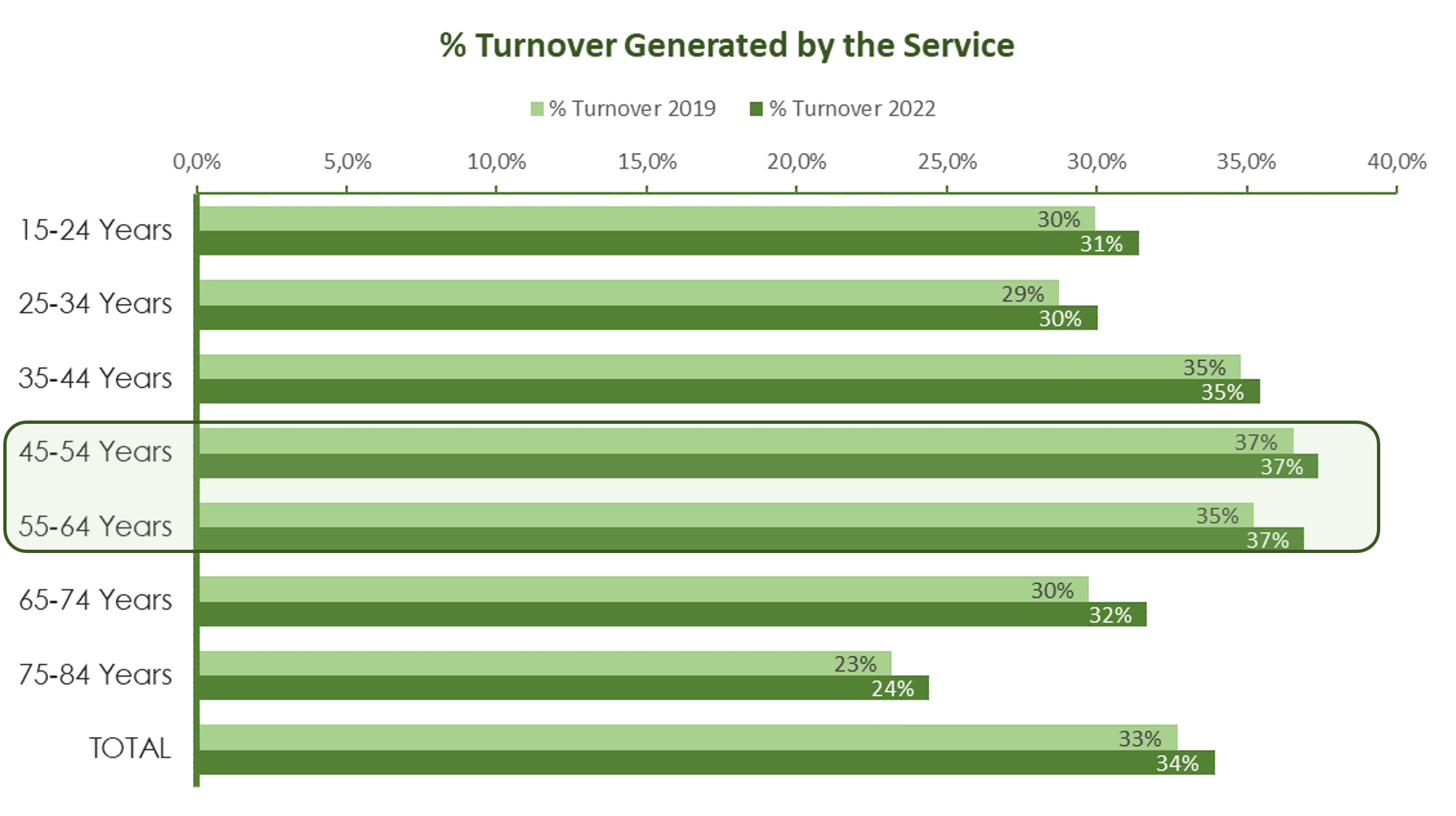

The “Boomer” consumers represent the core business of Italian salons. Against a 2% decrease in overall turnover generated by loyal/constant consumers (FY 2022 vs FY 2019) the 54-74 age group increases the turnover share at salons, raising the already important share of 43% in turnover generated in 2022 (up from 39% in 2019).

However, it must be considered that the increase in turnover generated by Boomers is the consequence of the increase in the number of consumers aged 55-74 (increased overall by 5%) and not in increased spending per consumer.

The importance of Boomers for the overall economy of salons is therefore proven by the fact that the average spending per consumer in 2022 was, for this age group, one of the highest of all (and practically double compared to consumers under 35).

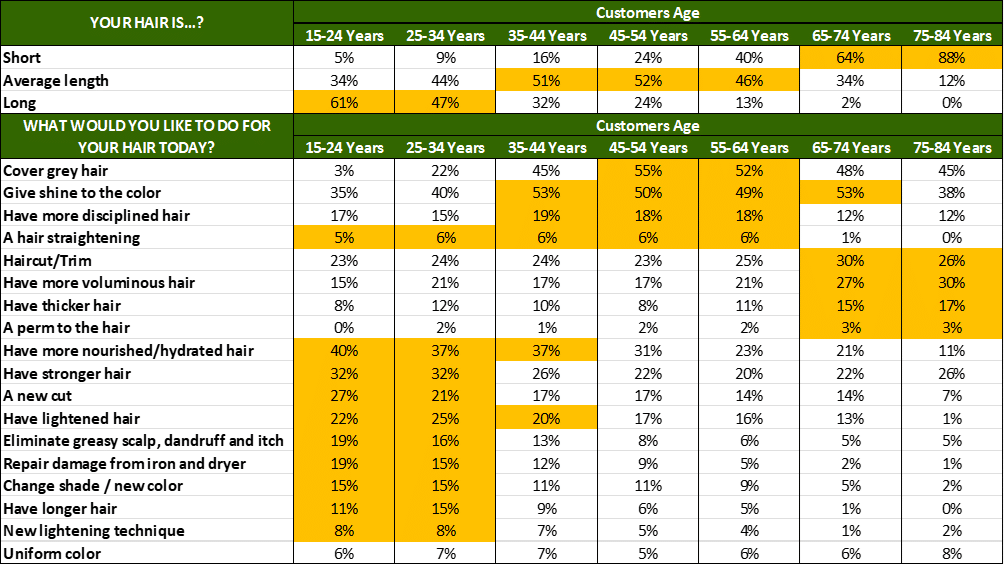

The Boomer generation includes a large segment of the population but does not represent a monolithic category of female consumers, and could perhaps be more effectively described by splitting it into 2 subcategories:

- “YOUNGER“ BOOMERS (55-64 years old): Professionally still active and with purchase behaviors closer to the 45-54 year old group: tendency to limit salon visits, concentrating them around more important services such as coloring or more expensive treatments, they purchase more products for use at home. Their average receipt is over € 60.

- “OLDER” BOOMERS (65-74 years old): As they leave the work world and have more time on their hands, they tend to move closer to the purchase behaviors of 75-84 years olds: salon visits become more frequent and less «demanding». They also go to the hairdresser just for styling, they tend to have their hair cut more often and the need to color their hair decreases. Treatments become more frequent but more simple. Their average receipt is decidedly lower.

BOOMERS AND STYLING

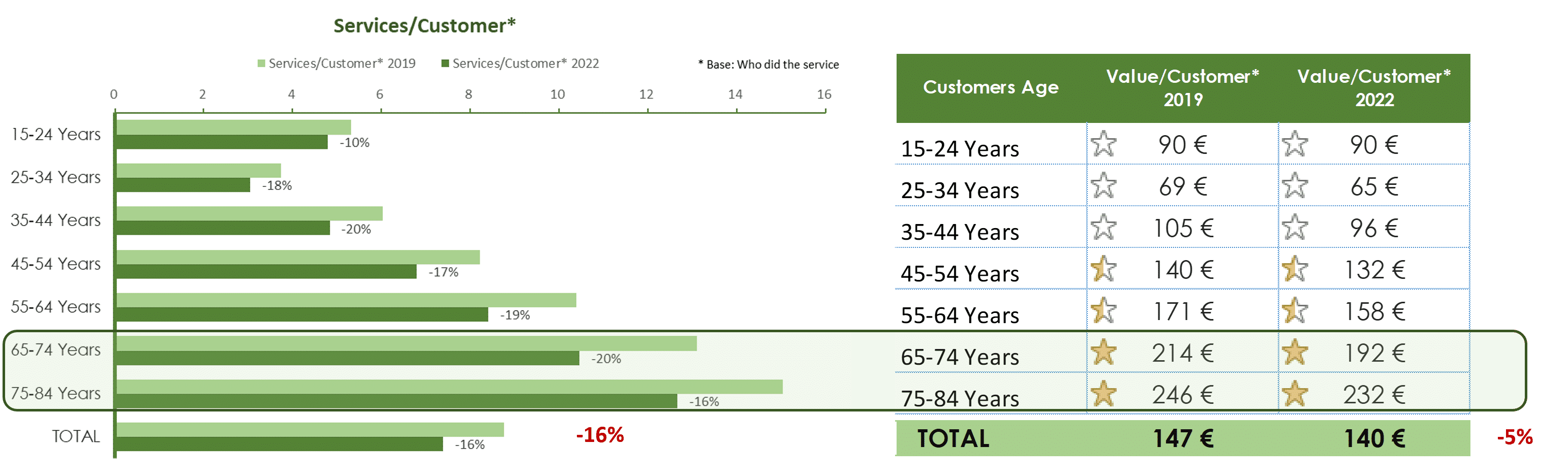

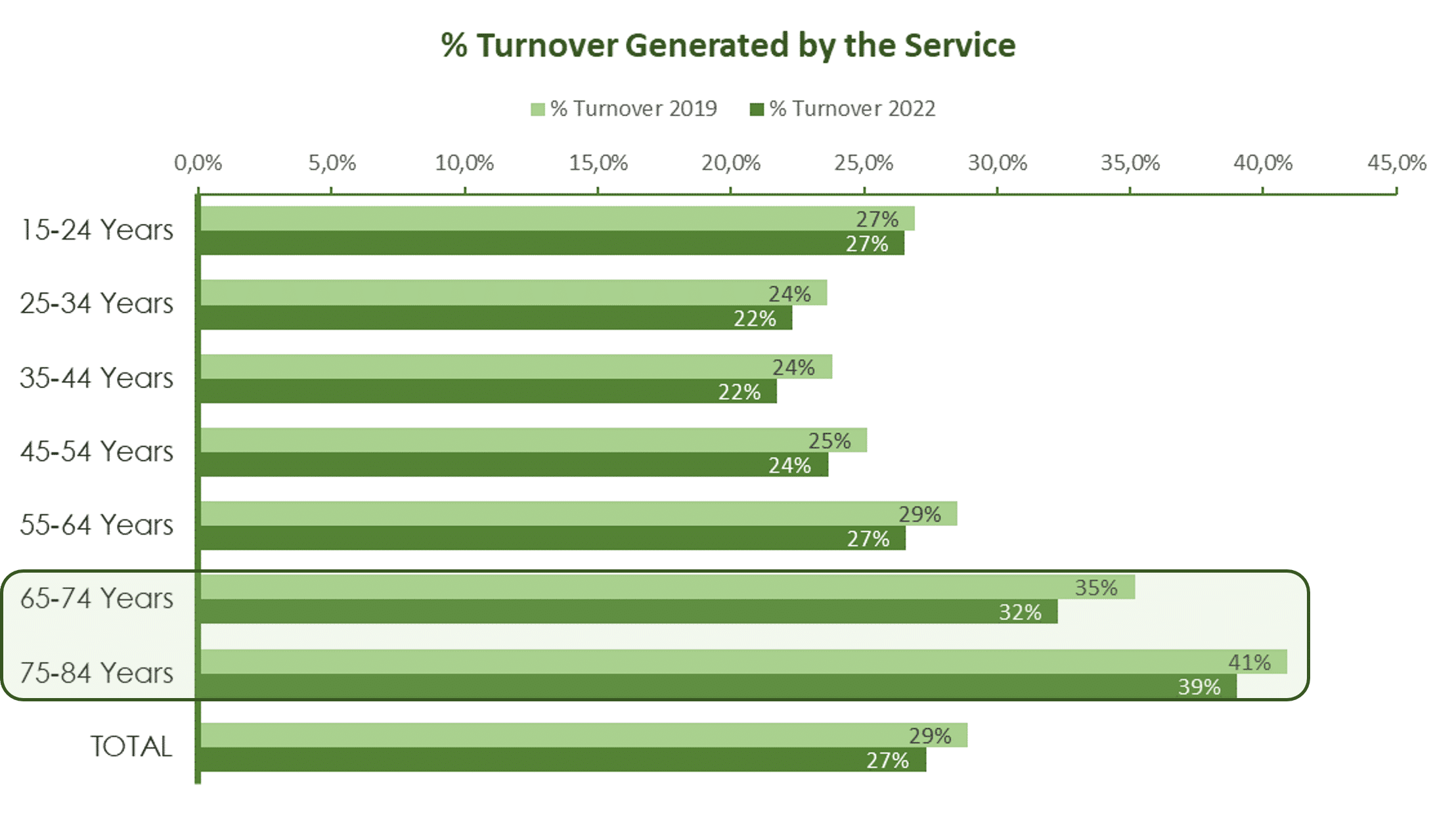

Styling is the service that has been hit hardest by the uncertainty caused by the pandemic in the last few years (turnover -7% among the loyal/constant consumers). The average number of services performed per client dropped 16%, while the average expense per client fell «only» by 5% due to the increase in the average price of the service (+13%).

This service becomes more regular and habitual as women age and thus characterizes the Boomer 65-74 age group: the average number of services performed, the average spending per consumer and the rate of service-generated turnover are definitely above average and below only the 75-84 age group.

BOOMERS AND COLORING

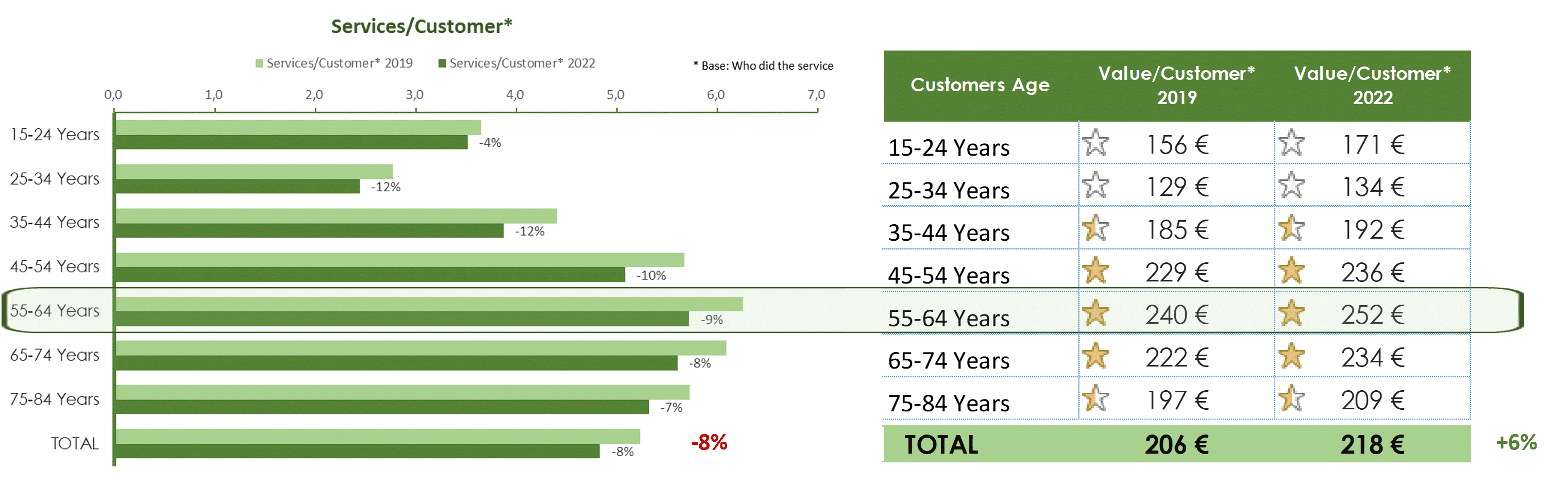

Coloring was hit less by the effects of the pandemic (turnover +2% among the loyal/constant consumers). The average number of services performed fell by 8%, while the average expense per client grew by 6% due to the increase in the average price of the service (+15%).

It is the service that most characterizes the 55-64 age group: the percentage of clients who performed at least one service in 12 months, the average number of services performed, the average expense per consumer and the rate of turnover generated by the service are the highest of all.

On the other hand, the 65-74 age group seems to have reduced investing in hair coloring, a trend that increasingly continues in the 75-84 age group.

A part of consumers was interviewed at the salon and one of the questions asked was:

What would you like for your hair today?

The collected responses confirm the presence of differences within the Boomer generation:

- The “younger” Boomers (55-64 age group) mainly have medium-length hair. When they go to the hairdresser they want to: cover grey hair, but also give shine to the color, have more disciplined hair (services closer to the 45-54 year old consumers)

- The “older” Boomers (65-74 age group) mainly have short hair. They express the desire for: more voluminous hair, thicker hair, a trim (closer to the 75-84 age group)

SEI INTERESSATO ALLE NOSTRE INDAGINI DI MERCATO?